One year out from midterm elections that could end Democratic control of Congress, spiking prices for goods -- from clothing to cars -- have plainly alarmed business leaders and ordinary Americans alike. As prominent economists in both parties flash warning signals, a Marist poll last month for NPR and the PBS NewsHour showed that inflation has surpassed wages and unemployment as the public's top concern about the US economy.

The resulting cascade of questions for White House officials yields a three-part response, though not one that has calmed worries that June's 5.4% increase in the consumer price index renewed this week. It was the largest such year-over-year increase since 2008.

First, Biden economists say, they're closely monitoring inflation and taking targeted action in response. Second, the bulk of the problem will ease before long as the bumpy reopening of the economy from pandemic shutdowns smooths out. And third, talk to Federal Reserve Chairman Jerome Powell, the independent official in charge of monetary policy who has echoed the White House in downplaying the inflation threat as almost certainly a temporary phenomenon.

"This is mostly the Fed's job, and they're treating it as mostly the Fed's job," explains Harvard economist Jason Furman, formerly a top economic adviser to President Barack Obama.

"But neither are we sitting on our hands," says Jared Bernstein, a member of Biden's White House Council of Economic Advisers who also served in the Obama administration. "We are doing, not just a lot, but more than I've even seen in this space."

An administration task force is working with private businesses to ease supply-chain bottlenecks driving up prices of autos and other consumer goods. It includes efforts to speed the movement of shipping containers through US ports and to ramp up manufacturing of semiconductor chips.

White House officials are also working with members of both parties in Congress on the semiconductor shortage. Legislation pending on Capitol Hill includes $52 billion in incentives for domestic production.

The pressure to do more

Outside critics, including Furman's former White House colleague Larry Summers, have urged Biden to do more. And though the current administration includes some more liberal economists who disdain Summers' views, they haven't brushed him off completely.

For example, amid complaints that enhanced federal unemployment benefits were raising labor costs by keeping Americans from returning to work, Summers urged Biden to signal that he would not seek to extend them past their September 6 expiration. The President subsequently signaled as much.

But the administration has shied away from other steps that might make a difference on the margins.

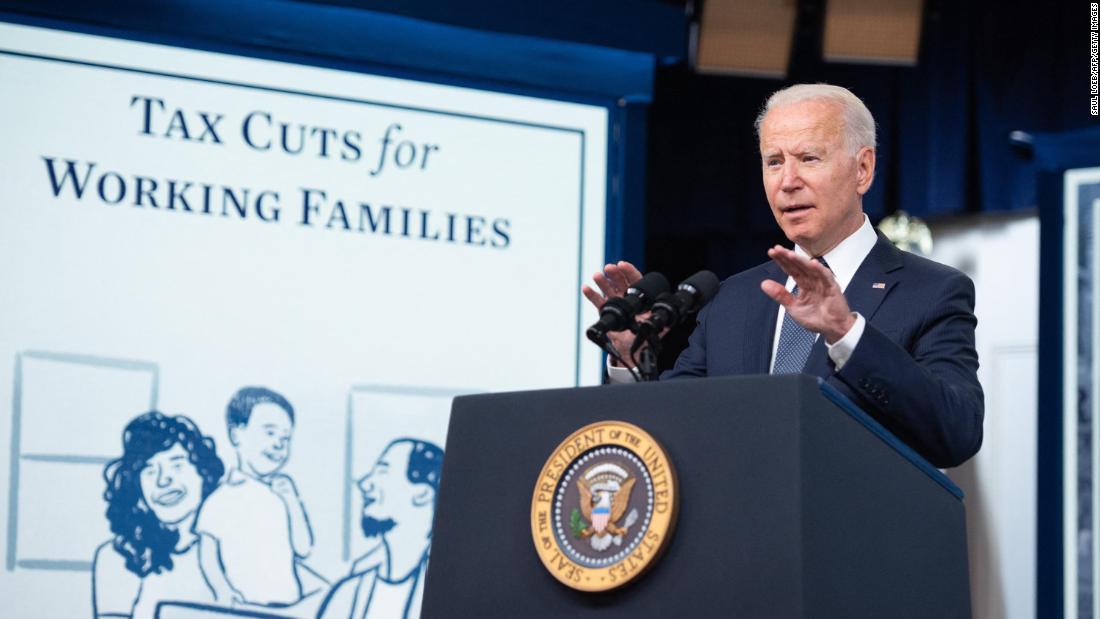

Summers, who had argued that the $1.9 trillion American Rescue Plan was irresponsibly large, has urged the administration to slow down its remaining outlays to diminish inflationary pressures. Biden's celebration Thursday of new monthly Child Tax Credit checks of up to $300 -- which outweigh the impact of higher prices on the millions of households receiving them -- demonstrated how little appeal that holds for the White House.

Similarly, the White House has not slowed the distribution of state and local government aid from the Rescue Plan even though that aid often exceeds the revenue loss it was designed to compensate for. With the public also alarmed about rising crime, the administration has told mayors the money can be used to hire police officers.

Cutting existing tariffs to tamp down price increases could toss away diplomatic leverage the US wants to preserve for foreign policy goals. And another step Summers has advocated -- having Biden sound louder public warnings to discourage expectations of future inflation -- poses the greatest risk of all.

Biden's top priority is his massive $4 trillion plan to brighten America's economic future through investments in infrastructure and support for struggling families. Republicans and some moderate Democrats have warned that it could hasten a return to the inflation levels that burdened the American economy a generation ago.

Since spending under the program would be spread out over years, White House economists consider that concern ill-founded. But underscoring a potential problem they consider temporary could have the effect of eroding support for the long-term objective Biden values most.

Moreover, administration economists say the infrastructure legislation itself would help ease inflationary pressure in areas such as housing. It includes significant investments for housing construction and rehabilitation that would expand supply.

While they wait for Congress to act, White House economists find reinforcement for their views in two key inflation indicators. Powell told the Senate Banking Committee on Thursday that expectations of long-term inflation remain "well-anchored" around the Fed's 2% target. And yields on 10-year Treasury bonds have declined since the spring, signaling that investors with billions at stake aren't yet fearful of a long-term inflation surge.

"House" - Google News

July 18, 2021 at 11:02AM

https://ift.tt/3er5scg

The White House's inflation headache - CNN

"House" - Google News

https://ift.tt/2q5ay8k

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "The White House's inflation headache - CNN"

Post a Comment