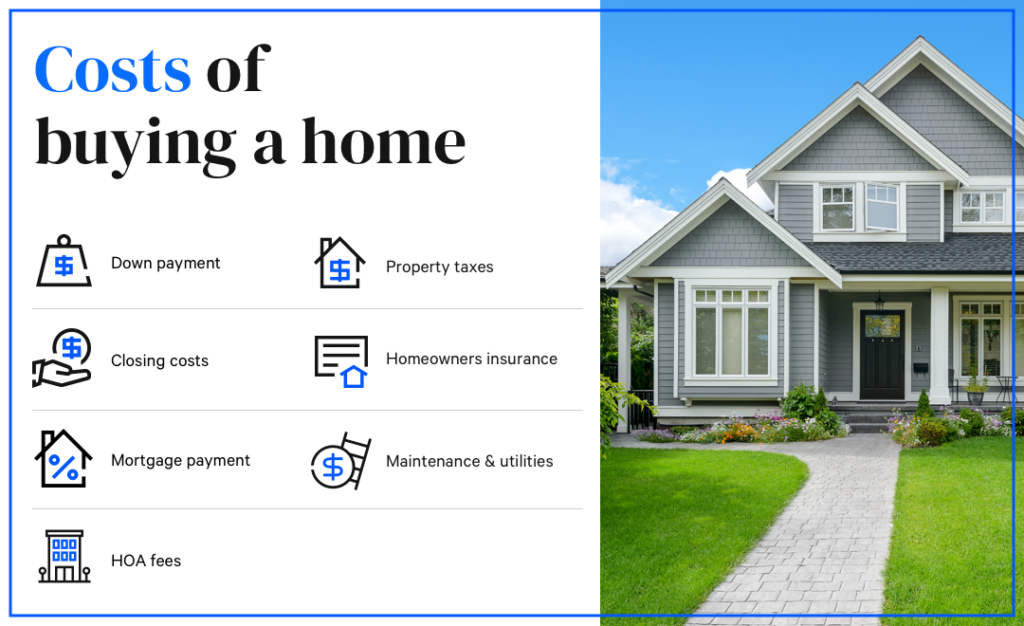

The list price may be the first thing that catches your eye when house hunting, but the actual cost of buying and owning a home is much greater. If you’re buying a home, here are all of the costs to consider.

Breaking down the cost of buying a home

Costs to pay upfront

In addition to the initial price tag of the home, expect two other upfront expenses: the down payment and closing costs.

1. Down payment

You’ll get the most favorable mortgage rates and avoid paying private mortgage insurance by making a down payment of 20 percent or more. That’s because lenders take on less risk with borrowers who put more money down. With a 20 percent down payment, you’ll pay $20,000 for every $100,000 of the home’s price. For example, on a $300,000 home, a 20 percent down payment would be $60,000.

There’s no requirement to make a down payment of 20 percent or more, and there are several low or no down payment mortgages out there that allow for less money upfront. Some conventional mortgage programs backed by Fannie Mae and Freddie Mac require just 3 percent down. (The caveat with these types of loans is that they may have income restrictions and require higher credit scores.)

FHA loans from the Federal Housing Administration require just 3.5 percent down, and you’ll need a credit score of at least 580 to qualify. VA loans and USDA loans don’t require a down payment at all, although you’ll need to meet certain criteria in order to be eligible.

2. Closing costs

Generally, you can expect to pay 2 percent to 5 percent of the purchase price in closing costs. In 2019, borrowers paid an average $5,749 in closing costs, according to ClosingCorp, a real estate data firm.

The actual amount you’ll pay depends on the location of the home, the home price and the local real estate market.

Closing costs include lender and third-party fees, which may include appraisal fees, credit report fees, origination fees, application fees, title search fees, title insurance and underwriting fees.

If you don’t have cash to pay for closing costs, ask your lender about no-closing-cost options. Some lenders will roll the expenses into the overall loan. Just keep in mind that doing so will cost you more in the long run, since you’ll be paying interest on the additional amount.

Expenses for homeowners

After the initial cost of purchasing a home, there are several ongoing costs to think about, as well.

1. Mortgage payment

Your monthly mortgage payment — the principal and interest — is one of the most predictable ongoing costs. You can use a mortgage calculator to figure out how much you’ll owe each month.

For example, if you borrow $240,000 and finance it with a 30-year, fixed-rate mortgage at 3 percent, you’d pay $1,011 in monthly principal and interest.

The mortgage rate you receive has a big impact on your monthly mortgage payment, which makes it crucial to shop at multiple lenders for the best mortgage rate. According to a Consumer Financial Protection Bureau study, more than three-quarters of all borrowers only applied for a mortgage with one lender, and failing to comparison-shop can cost you thousands over the life of the loan.

2. Homeowners insurance

Homeowners insurance generally covers the repair or replacement of the structure of your house and the contents within from disasters, theft and vandalism. The national average for home insurance in the U.S. is $2,305 per year, but the cost of homeowners insurance varies by state, the location of the home, the home’s condition and personal factors, such as your marital status.

3. Property taxes

The cost of property taxes differs widely by state and county, and your real estate agent can provide an estimate of what you’ll pay annually for the home you’re purchasing. The average property tax on a single-family home in 2019 cost $3,561, according to ATTOM Data Solutions.

It’s important to note that property taxes are not a fixed cost. Local governments adjust property tax rates annually depending on needs, so your annual bill could increase over time.

4. HOA fees

Homeowner’s association or HOA fees fluctuate by community and can be costly, ranging anywhere from $150 to $1,500 or more per month. The fees you pay to your HOA take care of amenities that, depending on the community, might include landscaping, pool maintenance, trash removal, utilities for common areas, security, fire alarms and pest control.

If you’re purchasing a home in an HOA, pay close attention to the HOA fees, how often they’re billed (monthly or quarterly) and what they cover.

5. Maintenance and utilities

It’s important to factor in common utilities like electric, water, gas and internet into the total ongoing cost of a home. Also include potential ongoing maintenance items, like landscaping, snow removal, trash and recycling pickup and other upkeep-related expenses.

At times, there are also bigger costs, such as an HVAC system that quits or a dryer that needs replacement. Consider budgeting for emergency home repairs and maintenance in the amount of 1 percent or more of your home’s value every year. For example, on a $300,000 home, your budget for maintenance-related items would be $3,000 annually.

How to prepare to buy a home

Once you’ve decided to purchase a home and weighed all of the costs, it’s time to start preparing. Here are some steps to take to prepare to buy a home.

1. Check your credit. Lenders use your credit score, along with other criteria, to determine your creditworthiness. You can get your credit score from each of the three major credit reporting agencies (Equifax, Experian and TransUnion) for free every 12 months from AnnualCreditReport.com. There are also many online services now offering credit scores for free — and your bank may do this, too. If your score is on the lower side, you may want to improve your credit before seeking out a mortgage.

2. Create a budget. Based on the costs listed above, create a realistic budget. Many experts recommend following the 28/36 percent rule, with which you should spend no more than 28 percent of your gross monthly income on housing and no more than 36 percent total on debt.

3. Save for a down payment. You’ll typically need at least 3 percent of the purchase price of the home as a down payment. Keep in mind that you’ll need to put at least 20 percent down to avoid private mortgage insurance.

4. Shop for a lender. Getting preapproved by a lender for a mortgage is helpful when shopping for a home. Not only does it make you look like a serious buyer to sellers, but it also provides you with a better idea of how much home you can truly afford. Start by shopping around and getting quotes from at least three lenders.

Bottom line

When it comes to how much money you need to buy a house, there’s more than meets the eye. Make sure to consider both upfront and ongoing expenses when creating a budget, and take a close look at your monthly finances to make sure that carrying a mortgage and paying for continuing expenses won’t be a financial burden long-term.

Featured image by pamspix of Getty Images.

Learn more:

"House" - Google News

July 31, 2020 at 03:14AM

https://ift.tt/3hP8FBG

How much money do you need to buy a house? - Bankrate.com

"House" - Google News

https://ift.tt/2q5ay8k

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "How much money do you need to buy a house? - Bankrate.com"

Post a Comment